Ecord the account name on the left side of the balance sheet and the cash value on the right. A lender will usually require a balance sheet of the company in order to secure a business plan. These operating cycles can include receivables, payables, and inventory. It is crucial to note that how a balance sheet is formatted differs depending on where the company or organization is based. This stock is a previously outstanding stock that is purchased from stockholders by the issuing company. If the company wanted to, it could pay out all of that money to its shareholders through dividends.

How Do I Calculate My Business’s Net Worth Using the Balance Sheet? – Questions About Balance Sheets

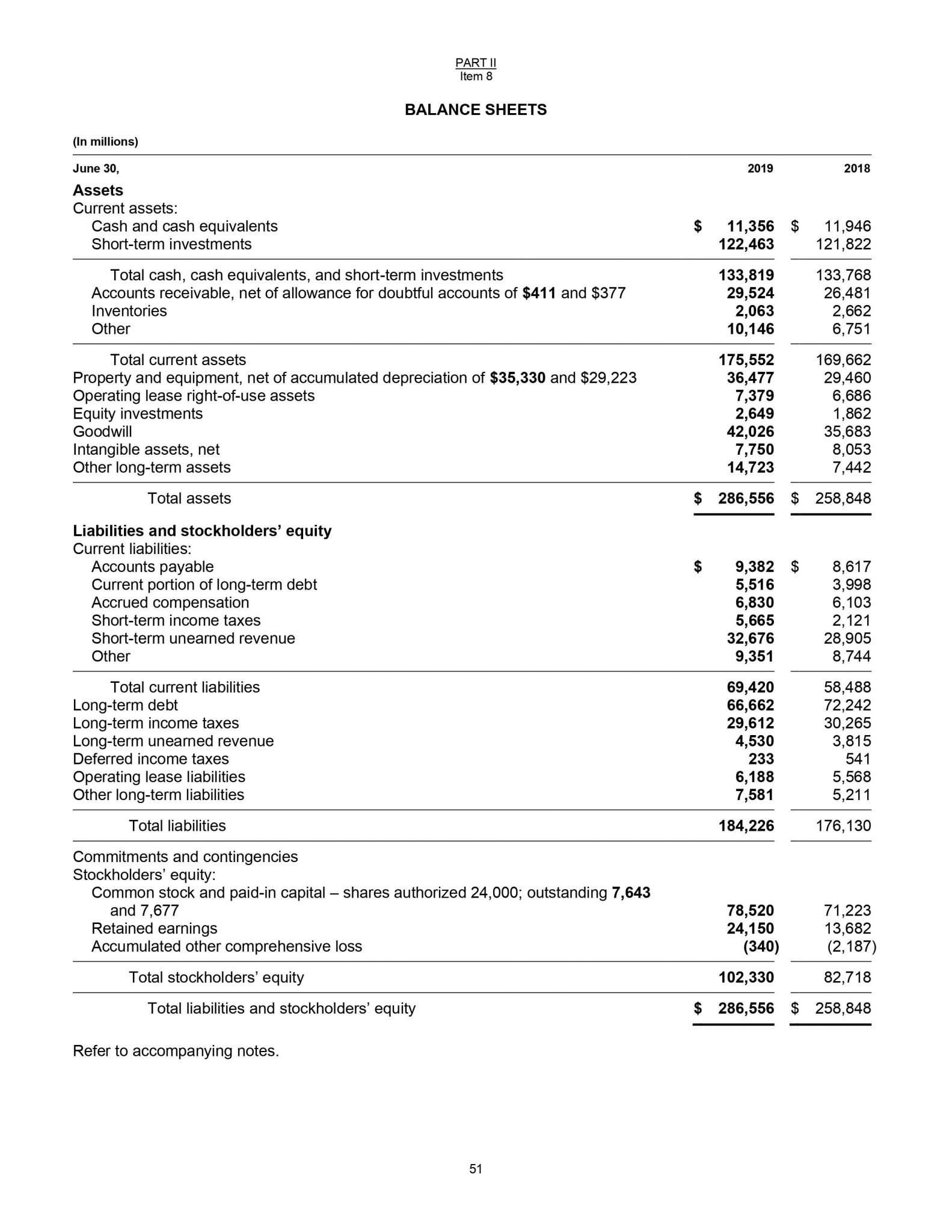

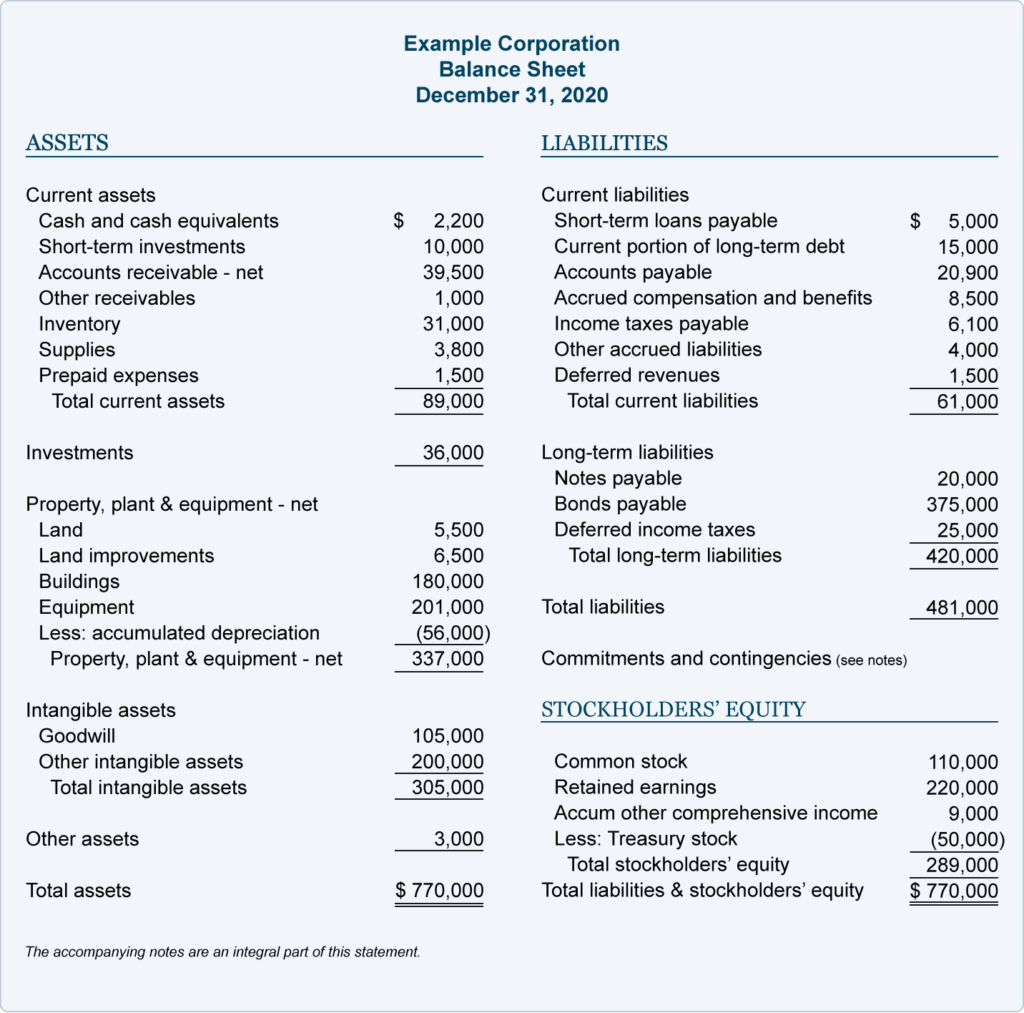

By weighing assets against liabilities, reading balance sheets paints a picture of business performance. The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out. Financial position refers to how much resources are owned and controlled monthly bookkeeping by a company (assets), and the claims against them (liabilities and capital). Assets, liabilities and capital balances are reported in a balance sheet, which is also known as statement of financial position. In order for the balance sheet to balance, total assets on one side have to equal total liabilities plus shareholders’ equity on the other side.

Long-Term Liabilities

We’ll cover how to prepare a balance sheet and how it can help you understand your business’s financial situation. Shareholder’s equity, also called owner’s equity, refers to a company’s net worth. You can calculate equity in a business by subtracting a business’s liabilities from its assets. Balance sheets exist, in part, to calculate equity and share a firm’s worth with investors. So, if a business liquidates its assets, owners know how much they will receive. On the surface, balance sheets seem like an administrative obligation businesses have to meet.

Where should we send your answer?

US GAAP includes basic underlying accounting principles, assumptions, and detailed accounting standards of the Financial Accounting Standards Board (FASB). Balance sheets are an inherently static type of financial statement, especially compared to other reports like the cash flow statement or income statement. Analyzing all the reports together will allow you to better understand the financial health of your company. Balance sheets can be used to analyze capital structure, which is a combination of your business’ debt and equity. Lenders will factor them into their decisions when doing risk management for credit.

- A balance sheet is a financial document that you should work on calculating regularly.

- However, retained earnings, a part of the owners’ equity section, is provided by the statement of retained earnings.

- When you’re starting a company, there are many important financial documents to know.

- Because of this, managers have some ability to game the numbers to look more favorable.

Activity Ratios

Both types of liabilities represent financial obligations a company must meet in the future, though investors should look at the two separately. Financing liabilities result from deliberate funding choices, providing insight into the company’s capital structure and clues to future earning potential. For many businesses, especially smaller ones, preparing and reviewing the balance sheet every month is a common practice. This regularity allows you to monitor short-term financial fluctuations and quickly identify emerging issues. At the very bottom of the balance sheet, you will see totals for assets and liabilities plus equity. Verifying that these numbers match allows you to confirm that the data in your balance sheet is correct.

How often are balance sheets required?

Operating liabilities include capital lease obligations and post-retirement benefit obligations to employees. The financial statements will now more faithfully reflect economic reality. The balance sheet is a benchmark for evaluating your business’s performance.

Assets are on the top of a balance sheet, and below them are the company’s liabilities, and below that is shareholders’ equity. A balance sheet is also always in balance, where the value of the assets equals the combined value of the liabilities and shareholders’ equity. This means that assets, or the means used to operate the company, are balanced by a company’s financial obligations, along with the equity investment brought into the company and its retained earnings. Some valuable items that cannot be measured and expressed in dollars include the company’s outstanding reputation, its customer base, the value of successful consumer brands, and its management team. As a result these items are not reported among the assets appearing on the balance sheet. Things that are resources owned by a company and which have future economic value that can be measured and can be expressed in dollars.

If necessary, her current assets could pay off her current liabilities more than three times over. Investors, business owners, and accountants can use this information to give a book value to the business, but it can be used for so much more. Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper. On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant.